Canada GST523-1 E 2018-2024 free printable template

Show details

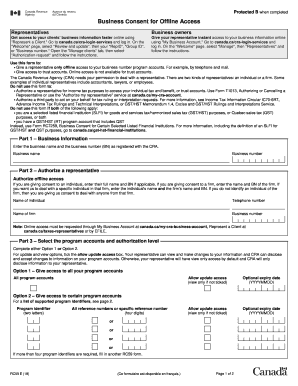

Complete Part E. NPO for that fiscal year. GST523-1 E 18 Ce formulaire est disponible en fran ais. Protected B when completed Complete Part D only if your percentage of government funding in Part C is less than 40 and this is not your first fiscal year of existence. Once we establish the eligibility of your organization we can process your public service bodies rebate application based on the information provided. While Form GST523-1 is filed once for each fiscal year a public service bodies...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your gst523 1 2018-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst523 1 2018-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst523 1 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit gst523 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Canada GST523-1 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out gst523 1 2018-2024 form

How to fill out gst523 1

01

To fill out GST523 1 form, follow the steps below:

02

Download the GST523 1 form from the official website of the tax authority or obtain a physical copy from their office.

03

Read the instructions and guidelines provided with the form carefully to understand the requirements.

04

Fill in your personal information, including your name, address, and contact details.

05

Provide the necessary information regarding your taxable activities, such as the type of goods or services you provide.

06

Calculate and enter the taxable amount for each category as per the guidelines provided.

07

Make sure to accurately report any related taxes or exemptions applicable to your business.

08

Double-check all the information you have provided to ensure its accuracy and completeness.

09

Sign and date the form.

10

Submit the filled-out form to the designated tax office either by mail or in person.

11

Keep a copy of the filled-out form for your records.

12

Remember to consult with a tax professional or refer to the official guidelines for any specific questions or doubts you have while filling out GST523 1 form.

Who needs gst523 1?

01

GST523 1 is required by individuals or businesses who are registered for Goods and Services Tax (GST) and need to report their taxable activities to the tax authority.

02

This form may be needed by various types of businesses, such as retailers, service providers, manufacturers, and wholesalers, who are liable to collect and remit GST.

03

Individuals who are self-employed or have a business with a certain level of taxable turnover may also be required to fill out GST523 1 form.

04

It is important to check the specific regulations and requirements of the tax authority in your jurisdiction to determine if you need to fill out this form.

Fill form 903 c 1 petition online : Try Risk Free

People Also Ask about gst523 1

What does GST stand for in Canada?

What is the GST HST tax in Canada?

How do I find my GST number Canada?

How do I create a CRA account in Canada?

Do I charge GST to US customers?

What is GST and HST in Canada?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file gst523 1?

The GST523 1 form is required to be filed by non-resident individuals who are temporarily residing in Canada, but are not considered residents for tax purposes. This form is used to report their income earned in Canada and to calculate their tax liability.

How to fill out gst523 1?

To fill out GST523-1, follow these steps:

1. Start by entering the taxpayer's name, business number (BN), and accounting period at the top of the form.

2. Section A: Sales and revenue

- Enter the total revenue earned during the reporting period for each applicable line.

- Calculate the total of all revenue.

- If you have zero-rated sales, enter the amount in the specified box.

- Calculate the total of all zero-rated sales.

3. Section B: GST/HST to be collected or claimed as an input tax credit (ITC)

- Enter the total amount of GST/HST collected or chargeable on your sales and other revenue in each applicable line.

- Calculate the total of all GST/HST collected.

- Enter the total amount of GST/HST paid or payable on your purchases and expenses.

- Calculate the total of all GST/HST paid.

- Calculate the net GST/HST to be remitted or claimed as an ITC.

4. Section C: GST/HST instalments or net tax to be remitted

- If applicable, enter the amount of GST/HST you have to remit for the reporting period.

- If you are claiming a refund, enter the amount in the specified box.

5. Section D: Interest, penalties, and other adjustments

- If you are calculating interest on late remittances or overdue amounts, enter the relevant amounts in this section.

- Provide explanations for any penalties or adjustments made.

6. Section E: Balance

- Calculate the total GST/HST payable or refundable by subtracting any overpayments from underpayments.

- Enter the amount in the specified box.

7. Sign and date the form, indicating the contact person's name, phone number, and address.

8. Keep a copy of the completed GST523-1 for your records and submit the form to the Canada Revenue Agency (CRA) as required.

Remember to carefully review all the information entered and ensure it is accurate before submitting the form.

What information must be reported on gst523 1?

The GST523 1 form, also known as the Application for New Housing Rebate, is used for claiming the Goods and Services Tax/Harmonized Sales Tax (GST/HST) new housing rebate.

When completing the form, the following information must be reported:

1. Applicant Information: The form requires the applicant's name, address, Social Insurance Number (SIN), and contact details.

2. Builder Information: The form asks for the builder's name, business number, address, and contact information.

3. Property Information: Details about the property being claimed for the rebate need to be provided, including the address, legal description, and the date it was substantially completed.

4. Purchaser Information: If the applicant is a signed purchaser on the Agreement of Purchase and Sale (APS), the purchaser's name and contact information must be included.

5. Consideration Paid: The amount of consideration paid (purchase price) for the property must be reported.

6. Builder's Rental Property Rebate: If the property is intended for rental purposes, information regarding the rental agreement, tenants, and any rental periods must be disclosed.

7. Two-year Occupancy: The form inquires whether the applicant or a close relative intends to occupy the property as a primary place of residence for at least two years from the substantial completion date.

8. Mortgage Information: Information about any mortgages or financing on the property should be provided.

9. Supporting Documents: The GST523 1 form may require supporting documents, such as the APS, occupancy agreements, rental agreements, or other legal contracts that verify the information provided.

It is essential to ensure accuracy and include all necessary information and supporting documents when completing the GST523 1 form to avoid delays or denial of the rebate claim.

What is the penalty for the late filing of gst523 1?

The specific penalty for late filing of GST523 1 may vary depending on the jurisdiction and applicable tax laws. It is recommended to consult the relevant tax authority or seek professional advice to determine the exact penalty for late filing.

How do I complete gst523 1 online?

Completing and signing gst523 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my gst523 non profit organizations form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your gst523 1 e and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out gst523 1 form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign gst523 form non profit organizations and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your gst523 1 2018-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

gst523 Non Profit Organizations Form is not the form you're looking for?Search for another form here.

Keywords relevant to gst 523 form

Related to form gst523 non profit organizations

If you believe that this page should be taken down, please follow our DMCA take down process

here

.