Canada GST523-1 E 2018-2026 free printable template

Show details

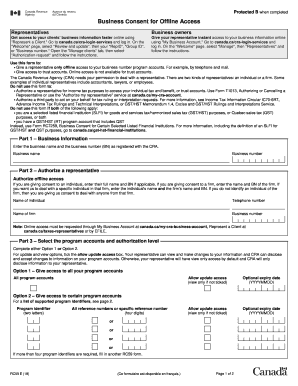

Complete Part E. NPO for that fiscal year. GST523-1 E 18 Ce formulaire est disponible en fran ais. Protected B when completed Complete Part D only if your percentage of government funding in Part C is less than 40 and this is not your first fiscal year of existence. Once we establish the eligibility of your organization we can process your public service bodies rebate application based on the information provided. While Form GST523-1 is filed once for each fiscal year a public service bodies...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign gst523 1 form

Edit your gst 523 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst 523 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst523 form online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit gst523 1 e form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST523-1 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 523 1 form

How to fill out Canada GST523-1 E

01

Obtain the Canada GST523-1 E form from the Canada Revenue Agency website or your local tax office.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information, including your name, address, and contact details in the appropriate sections.

04

Provide the required information about your business, such as the business number and the type of services or goods offered.

05

Detail your total sales and the amount of GST you collected, if applicable.

06

Indicate any other relevant financial information, such as input tax credits.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form either by mail or electronically, depending on the options provided by the Canada Revenue Agency.

Who needs Canada GST523-1 E?

01

Businesses that are registered for the Goods and Services Tax (GST) in Canada.

02

Individuals or entities that need to claim a refund of GST paid on business expenses.

03

Self-employed individuals who need to report their GST income and expenses.

04

Any business seeking to comply with GST requirements and maintain proper tax documentation.

Fill

form 523

: Try Risk Free

People Also Ask about

What does GST stand for in Canada?

The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs.

What is the GST HST tax in Canada?

GST/HST registrants collect tax at the 5% GST rate on taxable supplies they make in the rest of Canada (other than zero-rated supplies). Special rules apply for determining the place of supply. For more information, see Place-of-supply rules. The HST rate can vary from one participating province to another.

How do I find my GST number Canada?

If you can't find the GST/HST account number, contact your supplier. When your supplier does not provide their GST/HST account number, call the Canada Revenue Agency's Business enquiries line at 1-800-959-5525 to confirm it is registered.

How do I create a CRA account in Canada?

CRA BizApp mobile app Enter your social insurance number. Enter your date of birth. Enter your current postal code or ZIP code. Enter an amount you entered on one of your income tax and benefit returns. Create a CRA user ID and password. Create your security questions and answers.

Do I charge GST to US customers?

Usually, goods which are exported outside Canada and services given to non-residents are 0-rated under the GST rules. Technically, they're taxable, but the rate is 0%, which means that you don't have to charge anything.

What is GST and HST in Canada?

Goods and Services Tax (GST) / Harmonized Sales Tax (HST) definition. The GST/HST is a sales tax on supplies of most goods and services in Canada, as well as many supplies of real property and intangible personal property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Canada GST523-1 E online?

Completing and signing Canada GST523-1 E online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my Canada GST523-1 E in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Canada GST523-1 E and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out Canada GST523-1 E using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign Canada GST523-1 E and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is Canada GST523-1 E?

Canada GST523-1 E is a form used by businesses in Canada to report the election to use the simplified method for calculating the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) for eligible small businesses.

Who is required to file Canada GST523-1 E?

Businesses that are eligible to use the simplified method for calculating GST/HST and choose to opt for this method must file the Canada GST523-1 E form.

How to fill out Canada GST523-1 E?

To fill out Canada GST523-1 E, businesses need to provide their basic information, select the applicable election, and report any required figures as outlined in the form instructions. The form must be completed accurately and submitted to the Canada Revenue Agency.

What is the purpose of Canada GST523-1 E?

The purpose of Canada GST523-1 E is to allow eligible small businesses to report their choice to use the simplified method for calculating GST/HST, which can streamline the filing process and reduce compliance costs.

What information must be reported on Canada GST523-1 E?

The information that must be reported on Canada GST523-1 E includes the business name, business number, election details, and any applicable amounts related to the GST/HST calculations for the reporting period.

Fill out your Canada GST523-1 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst523-1 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.